My Day Trading Journey

How I Got Into It

I started day trading by using demo accounts on platforms like Trading 212 and TradingView. At first, it was all about getting a feel for how the markets work without risking real money. I spent time learning how to analyse charts, understand market trends, and predict price movements—all with virtual money, which gave me a solid base before diving in with real trades.

How I Trade

Research and Analysis

Before I place any trade, I do my homework. I use technical analysis tools on TradingView to look at things like moving averages and RSI (Relative Strength Index). These help me figure out the best times to buy and sell within the day. The goal is always to make quick, informed decisions based on what the market's doing at that moment.

Managing Risk

Day trading can be risky, so I always make sure I’m covered. I use stop-loss orders to limit any potential losses, and I never trade more than I’m comfortable losing. I also spread my trades across different assets to avoid putting all my eggs in one basket.

My Day Trading Routine

Morning Setup

Each morning, I kick off by checking the latest market news and doing some pre-market analysis. I use TradingView to see what happened overnight and create a watchlist of stocks I’m interested in for the day.

During Trading Hours

Once the markets open, I monitor my watchlist and look for opportunities to jump in and out of trades. Timing is everything, and I keep a close eye on price movements to make sure I’m making the right moves.

End of Day Reflection

At the end of each day, I go over my trades—what worked, what didn’t—and figure out where I can improve for the next day. This constant reflection helps me fine-tune my strategy.

Best Trades

One of my standout trades involved spotting a dip in a stock I’d been watching. After some analysis, I bought in just before a price surge and made a solid 15% gain in a single day. These are the moments that keep me hooked.

Tough Days

Of course, not every day is a win. I’ve had days where things didn’t go my way, and I took losses. But each mistake has taught me valuable lessons about managing risk, controlling my emotions, and sticking to my strategy.

Tools I Use

Community and Networking

Trading 212

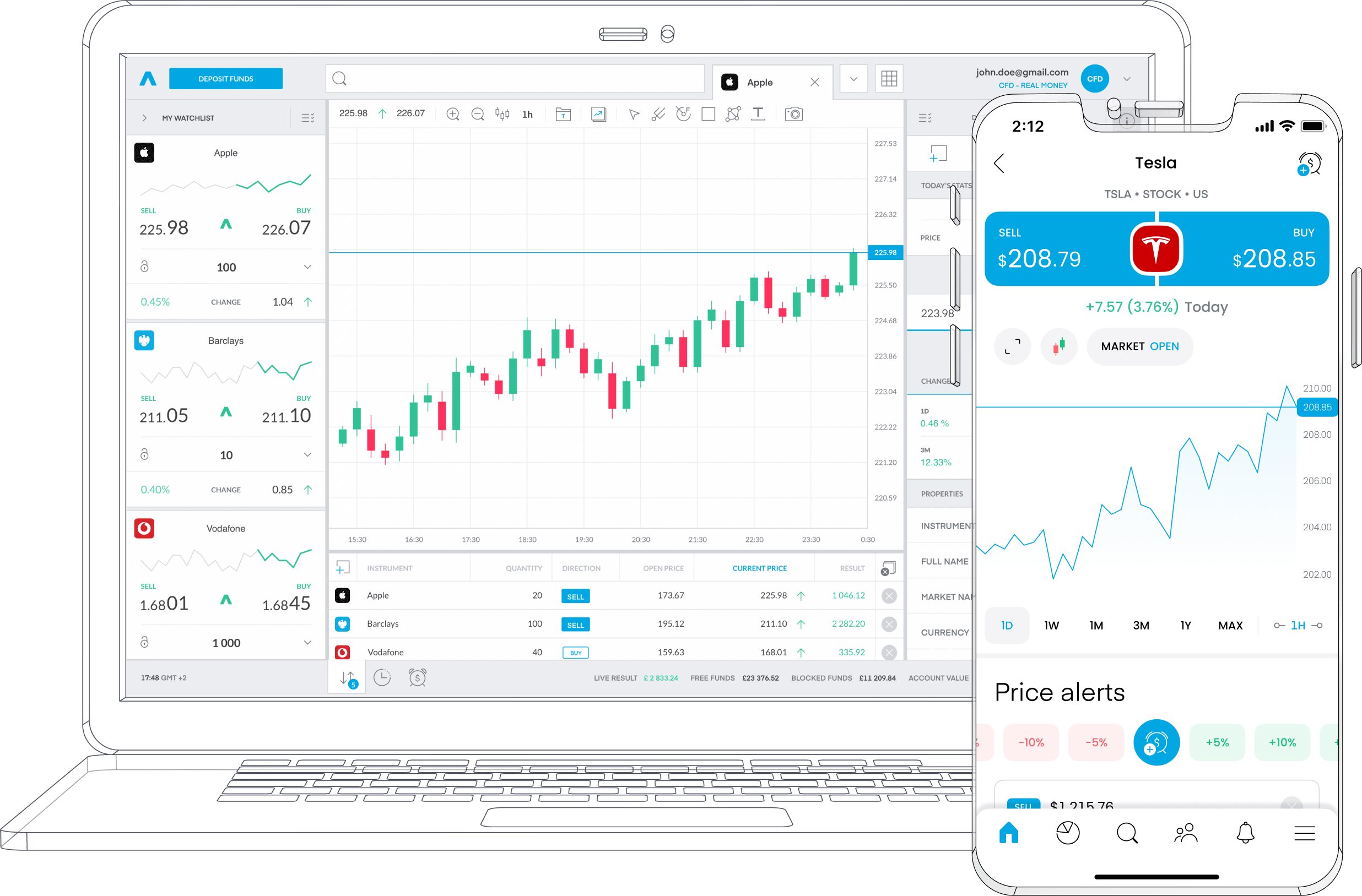

This is my main platform for executing trades. It’s easy to use, and it gives me access to a range of assets, including stocks and commodities.

TradingView

For charting and analysis, TradingView is my go-to. It’s got loads of technical indicators that help me spot trends and decide when to make a move.

I’ve built a network of fellow traders through platforms like Discord and Twitter. Connecting with other traders helps me stay in the loop with the latest market trends and get different perspectives on trading strategies.